Moderna (MRNA): Is the Long Accumulation Finally Over?

The biotech sector has always been a “high-risk, high-reward” playground for investors across the globe, from New York to Mumbai. Recent price action in Moderna, Inc. (MRNA) suggests that the stock, which spent much of 2025 in a grueling consolidation phase, may finally be ready to turn a corner.

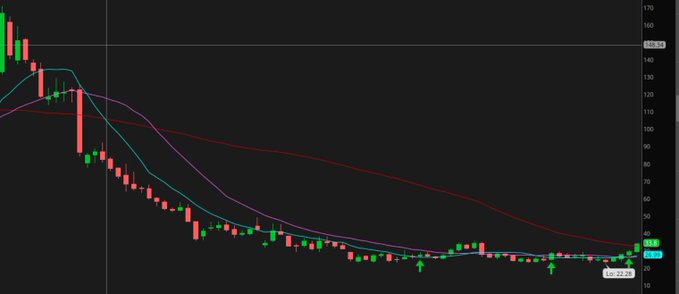

For patient investors who have watched Moderna’s “iceberg” of value remain largely submerged, the weekly charts are beginning to show a different story: one of a base being completed and momentum shifting to the upside.

The Technical Breakout: Confirmation on the Weekly Chart

As of December 21, 2025, Moderna’s technical setup has shifted from a neutral “wait-and-watch” stance to a budding bullish trend.

- End of Accumulation: After touching a 52-week low near $22.28, the stock established a firm base. The recent price action, characterized by higher lows, suggests that the heavy selling pressure that dominated the post-pandemic era has finally been absorbed.

- The Momentum Trigger: The most significant signal came this past week. Moderna decisively closed above the previous week’s high, finishing the week near $33.80. In technical terms, this “weekly breakout” often serves as the “green light” for institutional and retail traders that a new trend is being established.

- Moving Average Convergence: Price is now comfortably reclaiming key levels, including the 20-day and 50-day Simple Moving Averages (SMAs), shifting the short-to-medium-term bias to positive.

Strategic Risk Management: Hedging Over Stops

While the momentum is encouraging, Moderna remains a notoriously volatile asset. For traders in India and the USA alike, managing this volatility requires a more sophisticated approach than a simple stop-loss.

Why Stops May Fail: In a highly volatile biotech name, “stop-loss hunting” or deep intraday “whipsaws” are common. A tight stop-loss can be triggered by noise, kicking you out of a winning trade before the real move happens.

Instead of relying on deep stops that could lead to significant capital erosion, investors should consider hedging strategies:

- Protective Puts: Buying a put option at a lower strike price acts as “insurance.” If the price drops unexpectedly, the gain in the put option offsets the loss in the stock, allowing you to stay in the trade without fear of a total wipeout.

- The Protective Collar: For those concerned about the cost of puts, selling an out-of-the-money call option to fund the purchase of a put (a collar) can cap your downside risk for a very low net cost.

- Position Sizing: Given Moderna’s volatility, smaller position sizes combined with wider breathing room often yield better long-term results than a “full port” position with a tight stop.

Outlook for 2026

The fundamental narrative is also shifting. With Moderna narrowing its losses and diversifying its mRNA pipeline beyond COVID-19—into bird flu, oncology, and seasonal respiratory vaccines—the market is beginning to price in a “diversified biotech platform” rather than a one-hit-wonder.

Bottom Line: The weekly close above recent resistance is a major structural shift. While the road ahead will likely be bumpy, the “accumulation phase” appears to be in the rearview mirror.